Marginal Tax Rates: What Are They and How Do They Work?

The IRS just released the marginal tax rates for next year. But how do they work?

When you hear someone say, “I’m in the 24% tax bracket,” you might think all of their income is taxed at 24%. That can feel discouraging, especially if you’re trying to be wise with your money. But that’s not actually how our tax system works.

The U.S. has a progressive tax system based on marginal tax rates, which means your income is taxed in layers, not all at once. Understanding this not only helps you plan wisely, but also gives you a better understanding of how to steward the resources God has entrusted to you.

What Are Marginal Tax Rates?

A marginal tax rate is simply the percentage you pay on the last dollar you earn. Instead of taxing all of your income at one rate, the government divides income into brackets. Each bracket has its own tax rate, and you only pay that rate on the income that falls within that bracket.

Think of it like filling buckets with water. Each bucket represents a bracket, and once one bucket is full, the “overflow” goes into the next bucket, where it is taxed at a higher rate.

Marginal Tax Rate Example

Let’s look at a simplified set of brackets (Note: These are NOT the current tax brackets):

- 10% on the first $10,000

- 20% on the next $10,000 (from $10,001 to $20,000)

- 30% on the next $10,000 (from $20,001 to $30,000)

If you earn $25,000, here’s how your tax bill works:

- The first $10,000 is taxed at 10% = $1,000

- The next $10,000 is taxed at 20% = $2,000

- The final $5,000 is taxed at 30% = $1,500

Total tax = $4,500

Your marginal rate is 30% (because that’s the bracket your last dollar fell into).

Your effective tax rate is your average tax rate (Your total taxes paid divided by your total income).In this example, your effective tax rate is 18% ($4,500 ÷ $25,000).

Notice that you are not paying 30% on the entire $25,000, only on the portion above $20,000.

So, why does this matter?

First, you don’t “lose money” when you move into a higher bracket. Only the dollars in the higher bracket get taxed at the higher rate.

Second, you can plan wisely. Understanding brackets helps with year-end decisions like giving, retirement contributions, or deferring income.

Third, you gain perspective. Many people discover that their actual effective tax rate is lower than they feared.

What Are the 2026 Marginal Tax Rates?

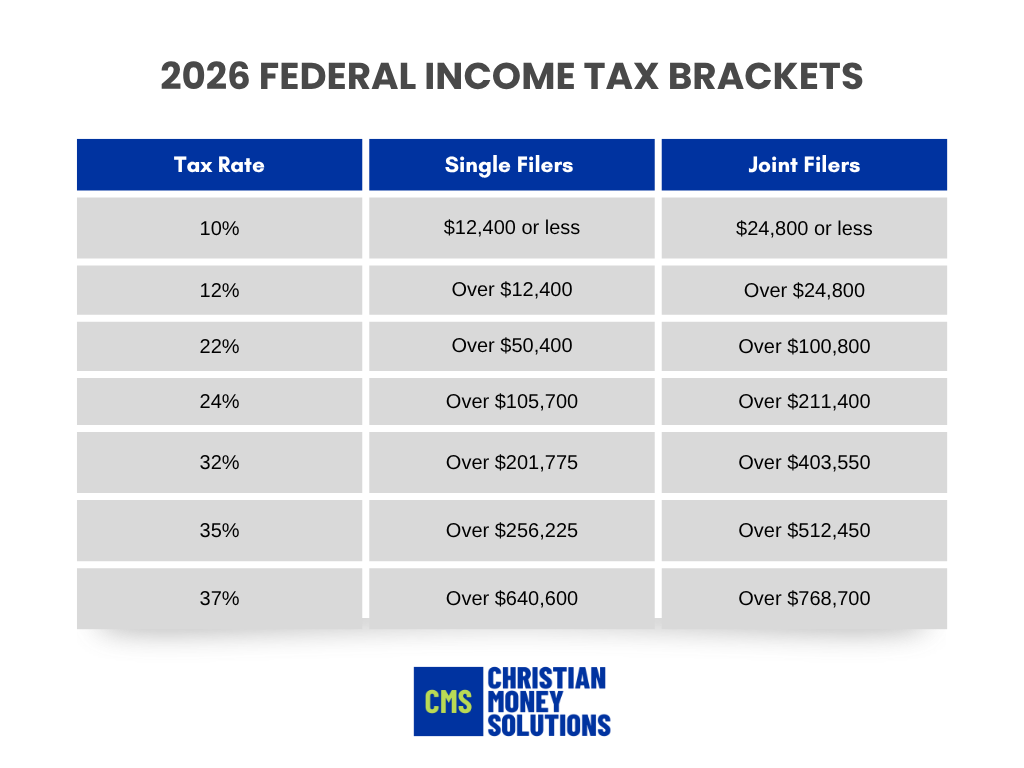

The IRS has announced the federal income tax brackets for the 2026 tax year. While the top tax rate remains 37%, the income thresholds have been adjusted.

The 2026 tax brackets are as follows:

For the 2026 tax year, the standard deduction is going up. Married couples filing jointly will see their deduction increase to $32,200. For single filers and married individuals filing separately, it will rise to $16,100. And for heads of households, the deduction will be $24,150.

A Biblical Perspective on Taxes

The Bible doesn’t shy away from the topic of taxes. In Matthew 22:21, Jesus famously said, “Give back to Caesar what is Caesar’s, and to God what is God’s.” Taxes may not be enjoyable, but they are part of living responsibly in society.

Romans 13:6–7 reminds believers that paying taxes is a way of honoring governing authorities and contributing to the common good:

“This is also why you pay taxes, for the authorities are God’s servants, who give their full time to governing. Give to everyone what you owe them: If you owe taxes, pay taxes…”

From a biblical standpoint, paying taxes is not just a legal duty, since God’s commands us to pay our taxes, it’s an act of faithfulness. It recognizes that everything we have belongs to God, and we are simply stewards. Of course, this does not mean that you shouldn’t legally utilize ways to reduce your taxes. It is wise to take full advantage of any opportunities to do so.

Takeaway

Marginal tax rates might sound intimidating, but they’re really just a way of dividing income into portions, with each portion taxed at its own rate. Knowing this truth helps believers:

- Avoid unnecessary fear about “losing” income to taxes.

- Make wise decisions about finances, giving, and planning.

- Honor God by obeying the law and practicing generosity.

By stewarding wisely, paying faithfully, and giving generously, you live out the truth that everything belongs to God.