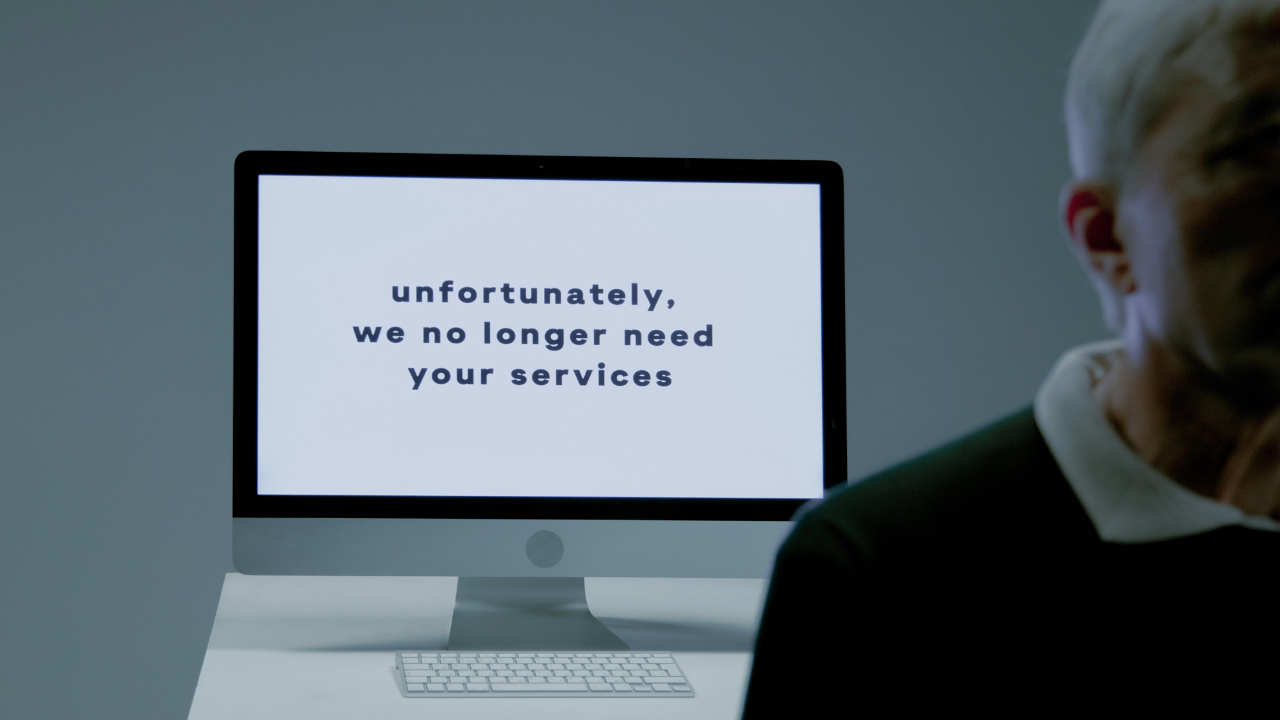

What Financial Moves to Make If You Get Laid Off

A layoff can turn your world upside down. One day, everything feels steady and secure. The next, you’re facing uncertainty about your job, your income, and your future. It’s normal to feel anxious, disappointed, even frustrated. But while the circumstances are difficult, there are wise steps you can take right now to steady your financial life and move forward with confidence.

1. File for unemployment immediately.

The first step is to file for unemployment benefits as soon as you are eligible. These benefits exist for moments like this, to help you bridge the gap until you get back on your feet. Even if you received severance from your employer, it’s still worth submitting a claim immediately. Get clarity about how much you’ll receive each week, how long the benefits will last, and what you need to do to remain eligible.

2. Review your severance package carefully.

Next, take some time to carefully review any severance package you are offered. Sometimes there are details buried in the paperwork, such as clauses about non-compete agreements or limitations around unemployment benefits. If you’re unsure about anything, it’s okay to ask questions or seek a second opinion. You’ll also want to ensure you receive any compensation for unused vacation or paid time off. This is not the moment to sign quickly and move on. Understanding these details will help you make wise decisions.

3. Keep health insurance coverage in place.

Health insurance is another critical piece to address. Losing a job often means losing employer-provided coverage, but you do have options. You can continue your current coverage through COBRA, though it is typically more expensive. If you’re married, you may be able to join your spouse’s plan. And thanks to special enrollment windows, you can also explore marketplace plans that may come with helpful subsidies. Even in a season of cost-cutting, don’t go without health insurance. One unexpected medical bill can become a major financial setback.

4. Assess your emergency fund and budget.

Once you’ve addressed those immediate items, turn your attention to your budget. You want to stretch your emergency savings as far as possible, so look for opportunities to temporarily reduce expenses. Prioritize the essentials—housing, food, utilities, transportation.

5. Hold off on major money moves.

Pause any retirement contributions for now and avoid major purchases or taking on unnecessary debt. If you find that your current budget still isn’t manageable, reach out to your mortgage company, landlord, or lenders early. Many will offer short-term assistance if you ask.

6. Look for other income opportunities.

While you tighten your spending, look for ways to bring in at least some income. This might mean picking up part-time work, freelancing, doing contract assignments, or even selling items you no longer use. It may not be what you ultimately want to do, but a temporary job can relieve financial pressure and give you more time to find the right long-term opportunity.

7. Update your resume and reconnect with your network.

Finally, start preparing for what’s next. Update your resume and online profiles. Reach out to former coworkers, mentors, and friends. Let people know you’re open to new opportunities. Sometimes God opens unexpected doors through the relationships we’ve built over the years. If your former employer offers career transition services, use them. They can help you sharpen your skills and make strong connections.

A layoff is difficult, no question about it. But it doesn’t have to define your future. With prayerful wisdom and intentional action, you can successfully navigate this season. Take things one step at a time. Protect what you have. Lean on the people who care about you. And remember that even when your job situation changes, God’s faithfulness does not.